Navigating the Facility Globe of Business Formation: Insights and Strategies

Embarking on the journey of developing a firm can be a complicated job, particularly in a landscape where guidelines are frequently progressing, and the stakes are high. As entrepreneurs established out to navigate the elaborate world of firm development, it comes to be critical to outfit oneself with a deep understanding of the complex subtleties that specify the procedure. From picking the most suitable company structure to ensuring rigid lawful conformity and creating reliable tax obligation planning strategies, the path to producing an effective organization entity is riddled with complexities. By untangling the layers of details and leveraging insightful strategies, business owners can pave the method for a solid structure that establishes the phase for future development and sustainability.

Service Framework Selection

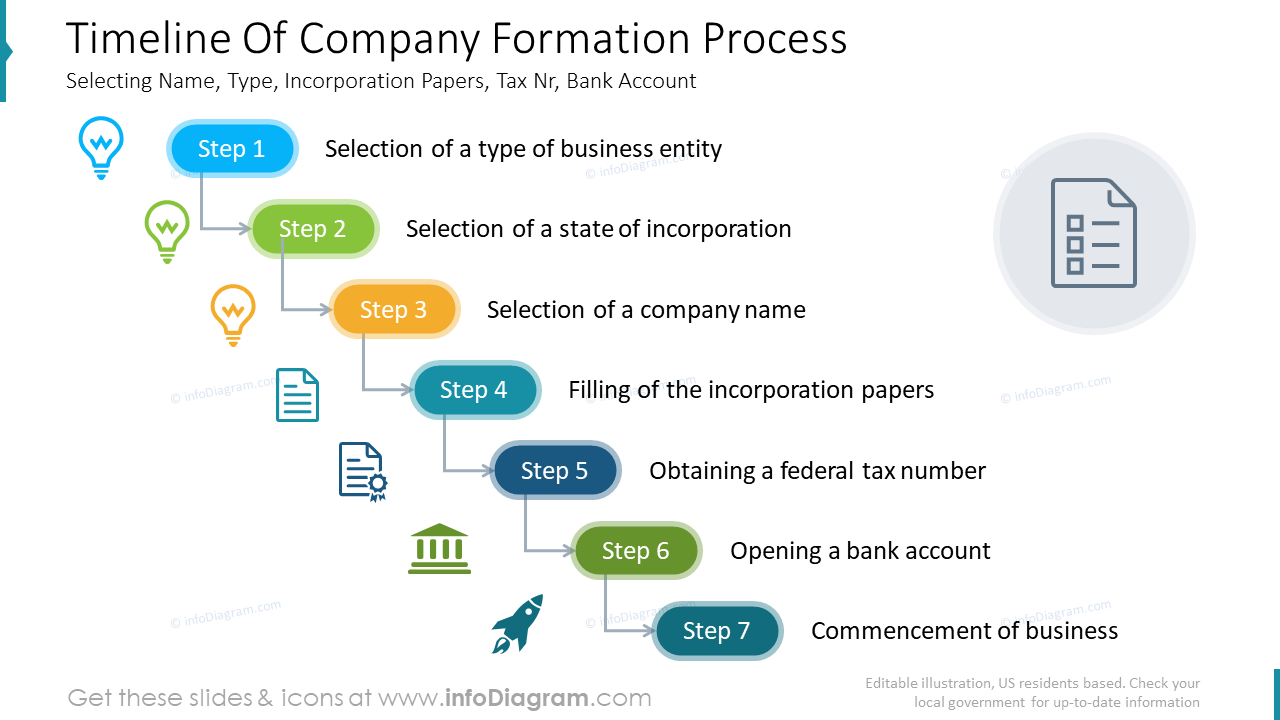

In the realm of company development, the crucial decision of selecting the suitable company structure lays the structure for the entity's functional and legal framework. The choice of business structure considerably impacts various aspects of the company, including taxes, responsibility, monitoring control, and compliance requirements. Entrepreneurs must meticulously review the readily available alternatives, such as single proprietorship, partnership, limited liability business (LLC), or company, to identify one of the most suitable structure that aligns with their service objectives and scenarios.

One typical structure is the sole proprietorship, where the owner and the business are considered the very same legal entity - company formation. This simpleness permits simplicity of formation and full control by the owner; however, it additionally requires unrestricted personal responsibility and potential difficulties in elevating capital. Collaborations, on the various other hand, involve two or even more people sharing profits and losses. While collaborations offer common decision-making and resource pooling, companions are directly liable for business's debts and responsibilities. Understanding the nuances of each service framework is vital in making a notified choice that establishes a solid groundwork for the firm's future success.

Legal Conformity Essentials

With the structure of a suitable organization framework in area, making sure lawful compliance essentials comes to be paramount for securing the entity's procedures and keeping governing adherence. Lawful compliance is crucial for business to operate within the borders of the law and prevent lawful problems or prospective fines. Trick legal compliance essentials include getting the necessary permits and licenses, adhering to tax guidelines, executing appropriate information defense actions, and complying with labor legislations. Failing to abide by lawful demands can cause fines, lawsuits, reputational damages, or perhaps the closure of the company.

To ensure lawful compliance, business should routinely review and upgrade their plans and procedures to mirror any type of adjustments in laws. Seeking legal advice or conformity professionals can additionally aid firms browse the intricate lawful landscape and remain up to date with advancing regulations.

Tax Planning Considerations

Additionally, tax obligation planning must include techniques to take benefit of offered tax credit reports, deductions, and motivations. By strategically timing income and costs, services can potentially lower their taxable revenue and total tax concern. It is also crucial to remain notified about changes in tax obligation legislations that may affect the company, adapting techniques appropriately to continue to be tax-efficient.

Moreover, worldwide tax obligation preparation considerations might occur for businesses running across boundaries, including complexities such as transfer rates and foreign tax obligation credit ratings - company formation. Looking for support from tax specialists can help browse these ins and outs and develop a comprehensive tax obligation plan tailored to the business's needs

Strategic Financial Monitoring

Effective financial administration entails a comprehensive method to looking after a firm's monetary resources, investments, and general economic wellness. By producing thorough budgets that straighten with the company's goals and purposes, businesses can allot resources efficiently and track efficiency versus monetary targets.

An additional vital aspect is money circulation administration. Keeping an eye on cash inflows and outflows, taking care of working funding effectively, and making sure adequate liquidity are crucial for the daily operations and long-term viability of a firm. In addition, critical monetary administration involves threat analysis and mitigation techniques. By identifying economic threats such as market volatility, debt threats, or regulative changes, firms can proactively carry out steps to safeguard their economic stability.

Additionally, financial reporting and evaluation play a crucial function in tactical decision-making. By generating exact monetary reports and carrying out thorough analysis, organizations can obtain useful insights into their monetary additional info performance, identify areas for enhancement, and make educated tactical choices that drive sustainable development and success.

Development and Expansion Methods

To drive a company in the direction of increased market visibility and success, critical growth and development techniques have to be carefully designed and executed. One efficient strategy for growth is diversity, where a company goes into brand-new markets or offers new items or services to minimize threats and capitalize on arising possibilities. It is important for firms to conduct complete market study, monetary analysis, and threat assessments prior to embarking on any type of development strategy to make sure sustainability and success.

Verdict

In conclusion, browsing the complexities of firm formation requires cautious consideration of business framework, legal conformity, tax planning, monetary administration, and growth approaches. By tactically selecting the appropriate service structure, making certain lawful conformity, intending for tax obligations, taking care of funds successfully, and applying development strategies, firms can set themselves up for success in the affordable company setting. It is very important for services check here to come close to company development with a extensive and critical attitude to accomplish lasting success.

In the realm of business development, the crucial choice of selecting the proper organization structure lays the foundation for the entity's functional and lawful structure. Business owners must very carefully review the offered alternatives, such as sole proprietorship, partnership, limited obligation firm (LLC), or corporation, to identify the most appropriate framework that straightens with their business goals and situations.

By producing thorough spending plans that align with the company's goals and goals, services can allot sources successfully and track efficiency versus economic targets.

In verdict, browsing the intricacies of company development needs cautious consideration of service framework, legal compliance, tax planning, financial management, and growth techniques. By strategically selecting the right organization framework, making sure lawful compliance, preparing for taxes, managing finances effectively, and applying development approaches, firms can establish themselves up for success in the affordable service setting.